It’s Time to be Pragmatic about Wheat Pricing.

Posted by GBA Administrator | Grain Brokers Australia News, Misc | No Comments15/08/16

The latest USDA report was generally bearish for wheat due to a 5mmt increase in production. World consumption was increased and stocks to use lowered but the march towards Aussie harvest in the face of these fundamentals is now starting to demand some clear strategy. We must think in terms of cash flow requirements and less so about recent price history.

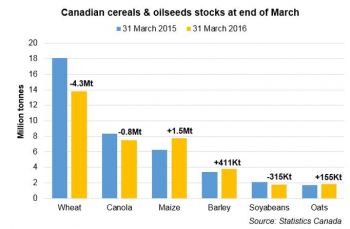

For a couple of weeks now there has been a fair bit written about the effects of wet weather on the quality and production of Western Europe’s wheat crops. It has been a positive story for wheat price outlook in the face of burdensome global stocks and another year of solid global production. Last week’s USDA report on world supply and production took the shine of that glimmer of hope, production in the EU was reduced 9mmt but it was cancelled out plus a bit more by increases to Russia and Black sea of 11mmt and Australia, Canada and the US, 3.6mmt. All together global production has been predicted to increase 5mmt.

Thankfully the lift in production forecast was offset somewhat by a reduction in Stocks and an increase in consumption of 3mmt, in signs that the pace of consumption is increasing due to lower global prices. The bottom line is this, bar some kind of unpredicted disaster, be it weather driven, political or some other form of intervention we are now most likely on track for a continuation of low wheat prices. Protein could continue to be an important factor in marketing your wheat and due to lower protein levels in Northern hemisphere harvests and some of the weather related quality issues we could see protein premiums continue to increase. Be sure to push for the best price and the best quality spreads when contracting. If you have low to no cover on 16/17 price we now suggest taking some cover on price at current levels to ensure cash flow and protect against being a forced seller in a potential buyers’ market come harvest time.

Tom Wake