USDA welcomes the New Year with very little fanfare…

Posted by GBA Administrator | USDA WASDE Report, Weekly Commentary | No CommentsReleased late last week, the January World Agricultural Supply and Demand Estimates (WASDE) report tends to be quite significant, given that it’s usually the final numbers in terms of yields, harvested area and production for the crop year in the United States (US).

However, the case is not closed on 2019 US production just yet as the United States Department of Agriculture (USDA) acknowledged it would resurvey producers in Michigan, Minnesota, North Dakota, South Dakota and Wisconsin for corn production and Michigan, North Dakota and Wisconsin when it comes to soybean production.

Heading into last Friday’s release, much of the market chatter suggested that the report would be bullish, based on the expectation of lower summer crop yields. But the opposite happened with the USDA raising the national yield for both corn and soybeans.

US corn production was forecast at 347.7 million metric tonne (MMT) with an average national yield of 10.55 metric tonne per hectare (mt/ha), slightly higher than last month’s yield estimate of 10.48mt/ha.

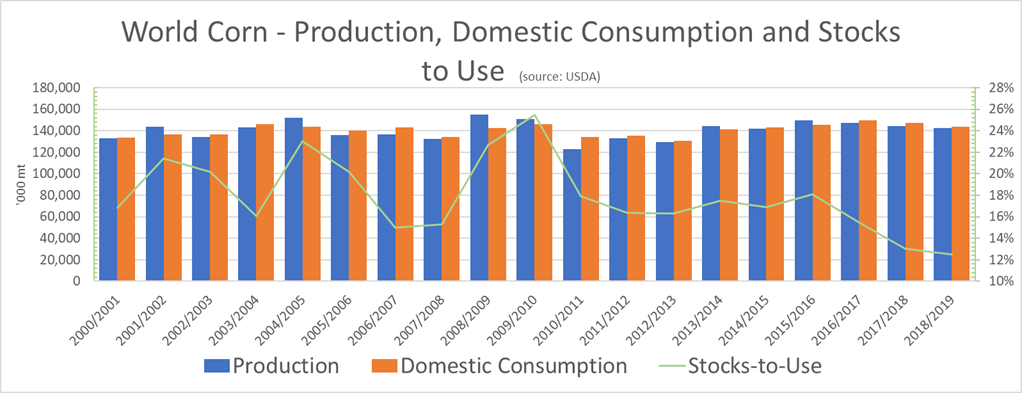

Globally, corn production in South America was left unchanged by the USDA with Brazil and Argentina forecast to produce 101MMT and 50MMT respectively. These numbers seem to belie the dry conditions being experienced in many parts of Brazil and Argentina this summer.

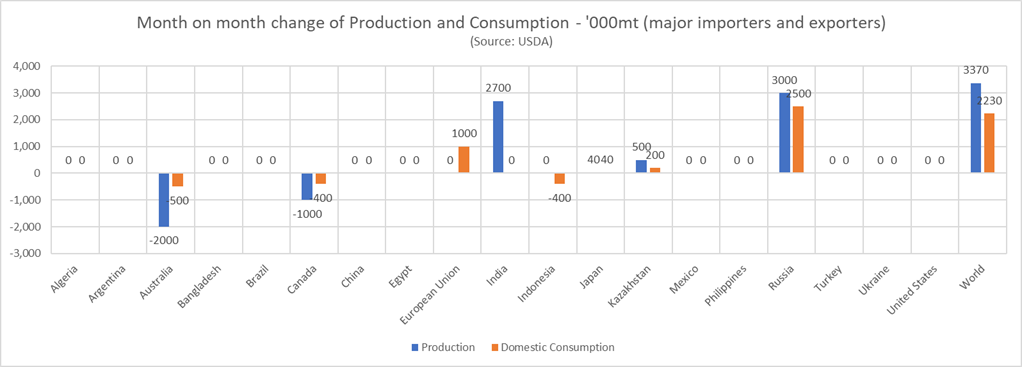

The only production increase amongst the major exporters was Russia which the USDA increased by 0.5MMT to 14.5MMT. The washup of all the changes was an increase in global output by a little more than 2 MMT to 850MMT excluding China, and 1,111MMT including China.

However, the bullish part of the corn equation comes in the demand number, increased by more than 6MMT globally compared to the December report. The US accounted for just under 6MMT with a 1MMT increase in China countered by a 0.5MMT decrease in Ukraine and several other minor downward revisions.

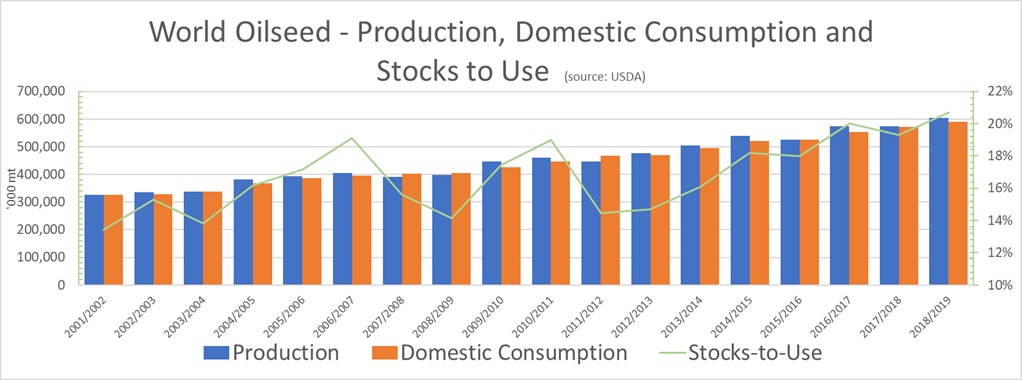

The USDA pegged final 2019 US soybean production 90.4MMT, on an average yield of 3.19mt/ha compared to 90.2MMT and an average yield of 3.15mt/ha in the December report. This was a surprise to most analysts who expected to see the impact of the extremely challenging season continue to ripple through the country’s soybean supplies. Nonetheless, this is still 20 per cent lower than the previous season’s production of 112.5MMT.

Like corn, the South American soybean production numbers remain steady with Brazil estimated to produce 123MMT this summer and Argentina expected to harvest 53MMT. Brazil’s National Supply Company (Conab) released estimates last week that seem to ignore drought worries and support the USDA number. They are forecasting soybean production at 122.2MMT off 36.8 million hectares.

Eventually, soybean losses will happen if it remains dry, but most agronomists believe that the current lack of moisture only affects the first corn crop at this point in the season. The state raising the biggest concern is Rio Grande do Sul, the top summer corn producer in the country. Conab maintained its estimate for first crop corn production at 26.6MMT, down 3.8 per cent compared with 2019, based on a 1.1 per cent increase in the seeded area.

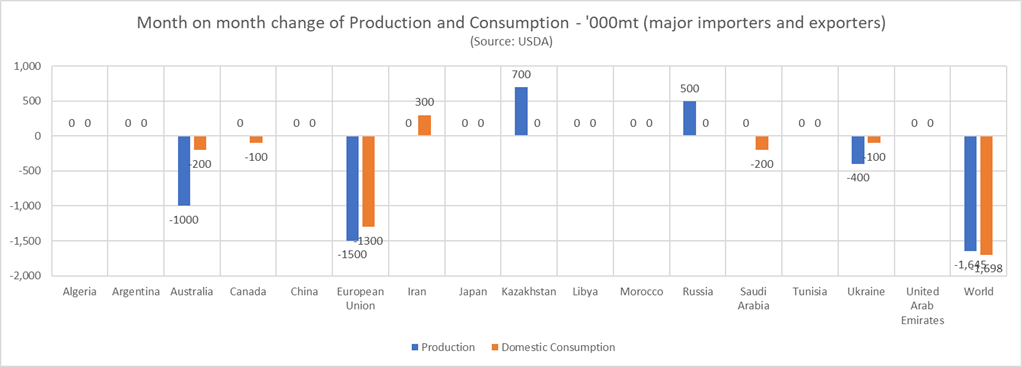

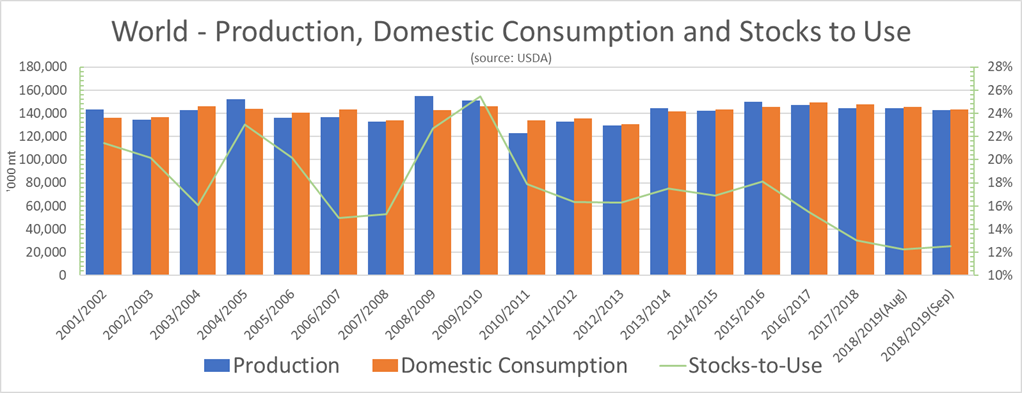

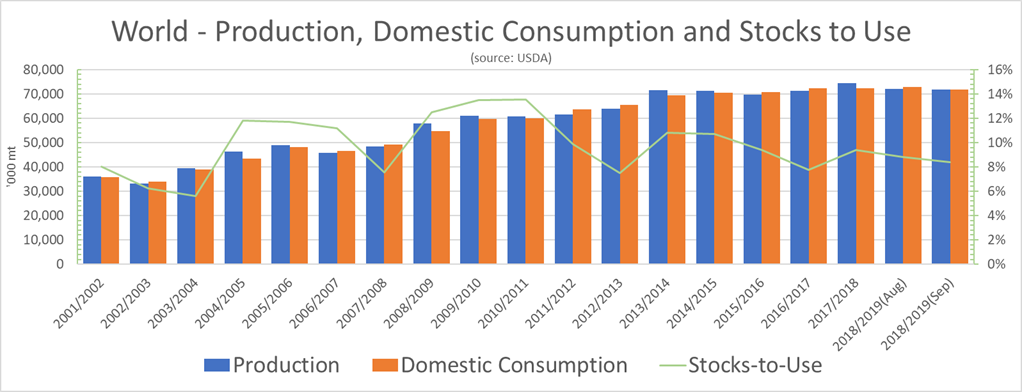

When it comes to wheat, global production for the 2019/20 marketing year was reduced by a meagre 1MMT to 764.4MMT. Half of that decrease was in Australia, where the USDA decreased production by 0.5MMT to 15.6MMT. While this is getting closer to reality, it is still at least 1MMT higher than the majority of domestic estimates.

Argentine production remained at 19MMT against the latest Buenos Aires Grain Exchange (BAGE) estimate of 18.8MMT. BAGE increased their estimate by 0.3MMT last week on the back of better than expected yields in the late-harvested regions. The balance of the global production decrease was in Europe with the Russian crop decreased by 1MMT to 73.5MMT and the European Union (EU) crop increased by 0.5MT to 154MMT.

On the wheat export front, global trade for the 2019/20 marketing year was increased by 1.3MMT to 181.1MMT. The US, Argentine and Canadian numbers were all unchanged compared to the December report. The major tweaking was in Europe where the Ukrainian and EU export numbers were increased by 0.5MMT and 2MMT respectively, and the Russian forecast was decreased by 1MMT on the back of lower supplies.

The USDA adjustment to the Australian wheat export number was hardly worth the token effort with a mere 0.2MMT shaved off expectations. Like the production forecast, the figure of 8.2MMT is at least 1MMT higher than most domestic expectations, and it simply should not be possible given domestic demand and the poor harvests receivals in Western Australia and South Australia.

Looking at the US new crop, the USDA reckons their farmers have planted 12.47 million hectares of winter wheat. This compares to 12.61 million hectares last year and is the smallest winter wheat area since 1909.

On the barley side of the equation, global production was decreased by 0.7MMT to 156MMT up more than 12 per cent, or 17.4MMT compared to the 2018/19 season. Australia was down 0.2MMT to 8.2MMT, EU up 0.5MMT to 62.75MMT and several minor producers collectively down by 1MMT.

The net change to global demand was minor at 0.1MMT, but the USDA did make some quite hefty regional adjustments to arrive at total demand of almost 153MMT. The big one was a 0.9MMT decrease in Chinese demand, potentially decreasing Australian exports over the coming months.

Countering that were demand increases of 0.4MT in the European Union and 0.6MMt in Turkey. Most importantly, Saudi Arabian demand was untouched at 8.5MMT, a year-on-year increase of 20 per cent or 1.5MMT. All this leaves 2019/20 global ending stocks at just under 21MMT, down 1MMT on last season’s number.

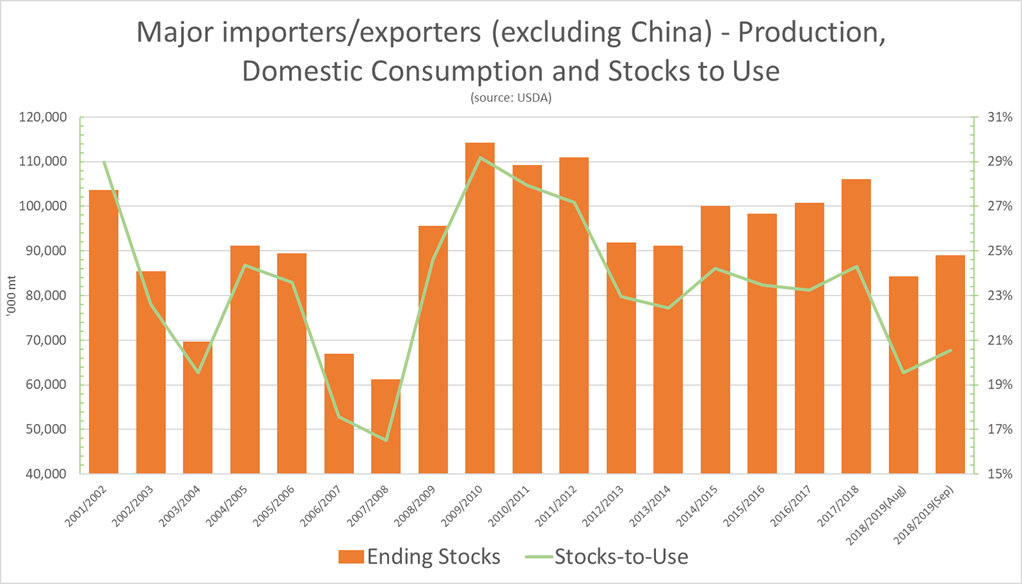

It could be said that last week’s WASDE report was mildly bullish for wheat, barley and corn, but on the whole, it was quite underwhelming for a report that invariably has huge trade and market ramifications.